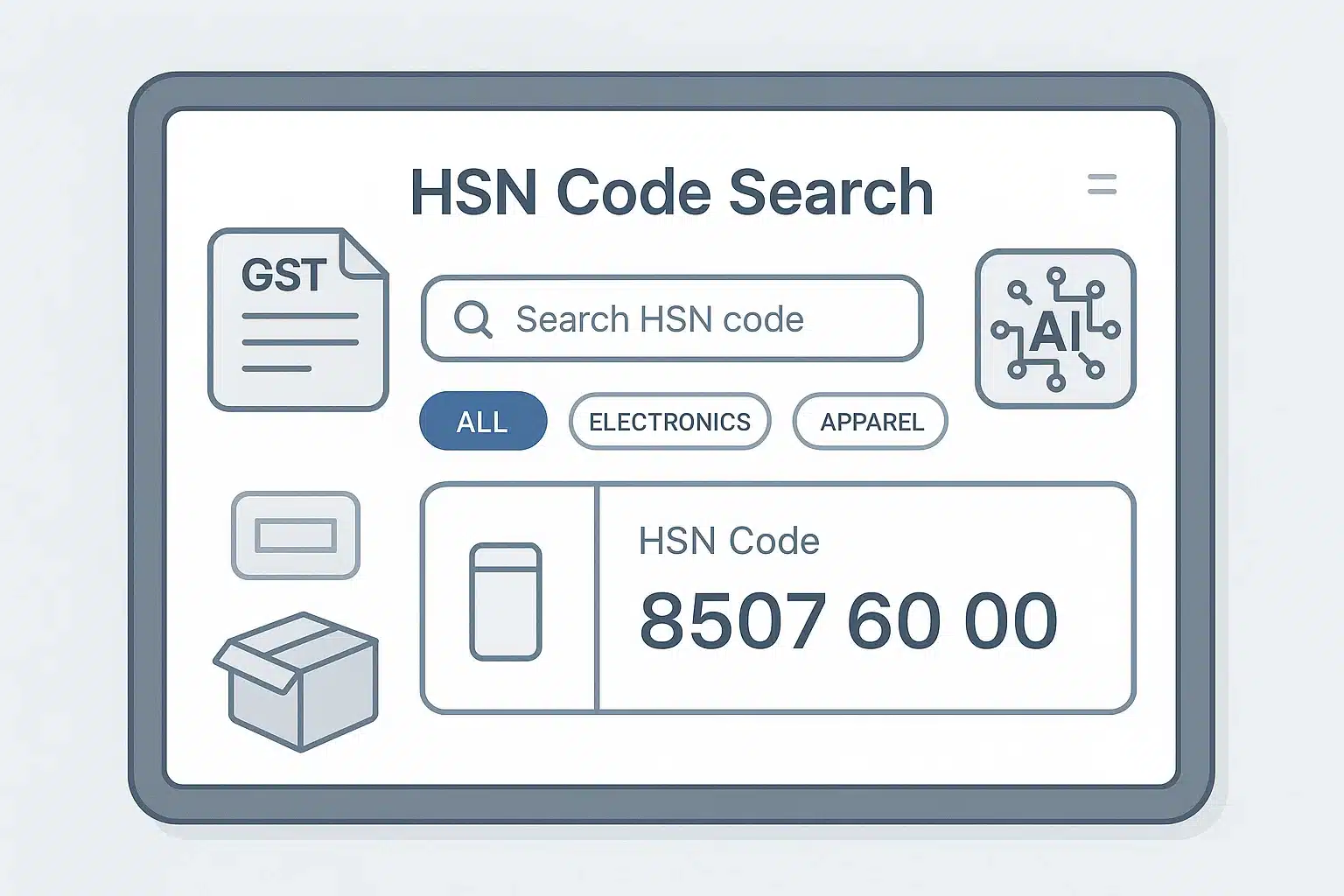

HSN Code Finder Get GST Rates Instantly

Instantly find the correct HSN code and applicable GST rate for any product. Our AI-powered HSN Code Finder simplifies product classification — fast, accurate, and completely free.

Find HSN Code Now

Why Accurate HSN Codes Matter

Understand what HSN codes are and why our finder is an essential tool for your business.

What is an HSN Code?

An HSN (Harmonized System of Nomenclature) code is an 8-digit code used to classify goods for GST purposes in India. It standardizes product classification, ensuring that GST rates are applied uniformly across the country. Proper HSN coding is mandatory for invoicing and tax filings.

Why Use Our HSN Finder?

- AI-Powered Accuracy: Get reliable HSN codes from simple product descriptions.

- Instant Results: Save time with our optimized AI-driven search.

- GST Rates Included: Find the applicable GST rate along with the HSN code.

- Ease of Use: Simple interface for effortless HSN code lookup.

AI-Powered Search

Simply describe a product to get an accurate HSN code suggestion.

Comprehensive Data

Get the HSN code, official description, and the latest GST rate information.

Mobile Friendly

Access our tool seamlessly on any device, anytime, anywhere.

AI-Powered HSN Code Finder

Describe your product (e.g., "men's leather shoes") or enter a 4-digit chapter code to get started.

Search Results:

Finding Your HSN Code is Easy

Follow these simple steps to use our HSN Finder tool effectively.

Enter Your Query

Type a clear product description or a 4-digit HSN chapter code.

Click Find

Our AI analyzes your input to find the most relevant information.

Get Your Results

Instantly receive the HSN code, description, and GST rate.

Key Benefits of Our Tool

Discover why thousands of businesses trust our tool for HSN code lookup.

Improve Accuracy

Minimize errors in your GST returns and e-way bills with correct HSN codes.

Save Time

No more tedious searching through government lists. Get answers in seconds.

Ensure Compliance

Stay compliant with GST regulations and avoid potential fines and legal issues.

Boost Efficiency

Streamline your invoicing and supply chain management processes effortlessly.

Who Can Benefit?

Discover various scenarios where accurate HSN information is crucial.

E-commerce Sellers

Quickly classify a wide range of products for online listings and GST invoices.

Accountants & CAs

Verify HSN codes for multiple clients to ensure accurate financial reporting and tax filing.

Logistics & Exporters

Determine correct codes for customs declarations, facilitating smoother international trade.

Manufacturers

Classify raw materials and finished goods correctly for inventory and compliance.

Retail Business Owners

Ensure accurate billing and stock management with proper product classification.

Tax Consultants

Advise clients on correct HSN usage and GST implications to avoid penalties.

See It In Action: Practical Examples

Here’s how our HSN Finder solves everyday business needs.

Generating a GST Invoice:

A small business owner selling handmade soaps needs the correct HSN code and GST rate to create a compliant tax invoice for a customer.

Filing Monthly GSTR-1 Returns:

An accountant needs to provide a summary of outward supplies categorized by HSN code. This tool helps verify the codes for all client products.

Listing a New Product Online:

An e-commerce seller is adding a new type of "bamboo toothbrush" to their store and needs to find the exact HSN code to set up the product listing correctly.

Preparing an E-Way Bill:

A manufacturer is shipping goods worth over ₹50,000 and must generate an E-Way Bill, which requires the correct HSN code for the consignment.

Import/Export Documentation:

An exporter is preparing a "Shipping Bill" for customs clearance and needs the internationally recognized 8-digit HSN code for their products.

Inventory Management:

A large retailer uses HSN codes to categorize their stock, helping them track sales trends and manage inventory levels for different product types.

Trusted by Thousands for 100+ Free Online Tools

Join a growing community of creators, developers, and businesses who rely on our all-in-one tools platform for secure, fast, and free online tools. Your trust is our top priority—no sign-ups, no hidden costs, and complete privacy.

Frequently Asked Questions

Find answers to common questions about HSN codes and our tool.

The Harmonized System of Nomenclature (HSN) is an internationally standardized system of names and numbers to classify traded products. In India, it's used for GST purposes to ensure uniform classification and taxation of goods.

Our tool uses an advanced AI model trained on official HSN classifications to provide highly accurate suggestions. However, for legal and high-value transactions, we always recommend cross-verifying with a tax professional.

Yes, our HSN Code Finder tool is completely free for all users. There are no hidden charges or subscription fees.

Your search history is saved locally in your browser for your convenience using your browser's localStorage. We do not store your search queries on our servers, ensuring your data remains private and is only accessible on your own device.

Have more questions?

Contact Us