GST Slab Changes in India 2025: Full Details & New Rates

Table of Contents

- 1.What are the 2025 GST Slab Changes?

- 2.Key Impacts of the New Slabs

- 3.GST RATE CARDS- New 2025

- 4.How to Calculate New GST (Step by Step)

- 5.Compliance & Best Practices for Businesses

- 6.Impact on Different Sectors

- 7.Common Compliance Errors & Solutions

- 8.Comparison with Global Tax Structures

- 9.FAQs

- 10.Conclusion

In a landmark move, India has taken a historic step to simplify its Goods and Services Tax (GST) structure. During the GST Council meeting on September 3, 2025, major reforms were announced that will reduce the number of GST slabs, make essential items cheaper, and boost overall consumption in the economy.

These changes will officially take effect from September 22, 2025, just before the festive season, making it a huge relief for consumers and businesses alike.

👉 Calculate your new costs: Use Our Free GST Calculator

What are the 2025 GST Slab Changes?

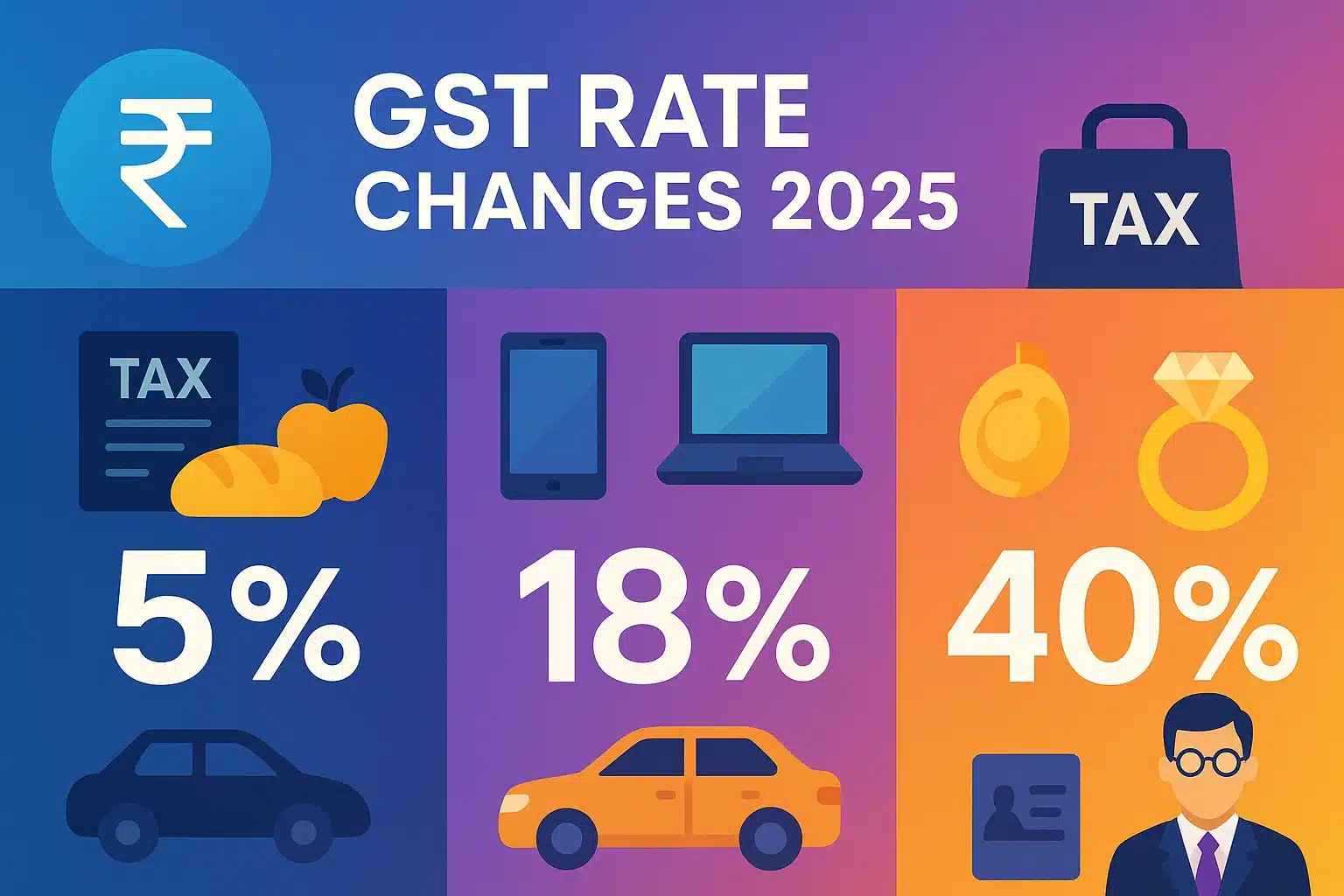

The primary goal of the 2025 revision is to rationalize the complex multi-slab structure into three simple categories. The previous four GST slabs — 5%, 12%, 18%, and 28% — have been consolidated, making tax calculation and compliance significantly easier for everyone.

New GST Slabs at a Glance (Effective Sep 22, 2025)

| Category | Old GST Rate | New GST Rate |

|---|---|---|

| Household essentials | 5% | 0% (Nill) |

| Life-saving drugs, medicines | 12% | 0% (Nill) or 5% |

| Two-wheelers, small cars, TVs, ACs, cement | 28% | 18% |

| Farm machinery, irrigation equipment | 12% | 5% |

| Tobacco, pan masala, aerated drinks, and luxury goods | 28% + Cess | 40% |

- ✅ Radical Simplification: Moving from four-plus slabs to just three simplifies compliance dramatically.

- ✅ Price Reduction: Many goods from the 12% and 28% slabs will now fall into the 5% or 18% slab, becoming cheaper.

- ✅ Clearer Classification: The three-tier system reduces ambiguity in classifying goods and services.

- ✅ Increased Revenue from Luxury Goods: A higher flat rate on luxury items aims to balance the revenue loss from other categories.

Category-wise GST Rate Changes (2025)

Medical & Health

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Medicines for rare diseases and cancer | 5 | 0 | Exemption |

| Other medicines (Ayurveda, Unani, Homeopathy) | 12 | 5 | Reduced |

| Medical oxygen | 12 | 5 | Reduced |

| Diagnostics kits and installations | 12 | 5 | Reduced |

| Nucleic acid testing kit | 12 | 5 | Reduced |

| Spectacles, contact lenses, vision testing equipment | 12 | 5 | Reduced |

| Thermometer | 18 | 5 | Reduced |

Toys

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Sports equipment, scooters, pedal cars, etc. | 12 | 5 | Reduced |

| Toys (excluding electronic toys) | 12 | 5 | Reduced |

| Board games (Ludo, Carrom, Chess, Cards) | 12 | 5 | Reduced |

| Wooden, metal, stone handicrafts and idols | 12 | 5 | Reduced |

| Lamps | 12 | 5 | Reduced |

| Brass, copper, aluminum artifacts | 12 | 5 | Reduced |

Auto Parts

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Bicycle and bicycle parts | 12 | 5 | Reduced |

| Motorcycle's fuel cell | 12 | 5 | Reduced |

| Two-wheeler (bike/scooty below 350cc) | 28 | 18 | Reduced |

| Small car (below 1200cc petrol, 1500cc diesel) | 28 | 18 | Reduced |

| Three-wheeler | 28 | 18 | Reduced |

| Passenger vehicle (more than 10 seater) | 28 | 18 | Reduced |

| Engine parts, engine oil, pump (vehicle) | 28 | 18 | Reduced |

| Auto parts | 28 | 18 | Reduced |

Students and Education

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Eraser (rubber) | 5 | 0 | Exemption |

| Paper for textbooks/notebooks (except printing) | 12 | 0 | Exemption |

| Maps, Atlas, Globe (printed) | 12 | 0 | Exemption |

| Pencil, crayon, pastel, canvas | 12 | 0 | Exemption |

| Pencil sharpener | 12 | 0 | Exemption |

| Geometry box / Color box | 12 | 5 | Reduced |

| Paper cartons and boxes/Tray | 12 | 5 | Reduced |

Construction Materials

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Marble/travertine block, granite block, sand-lime bricks | 12 | 5 | Reduced |

| Granite, zinc dust, particle board from agricultural waste | 12 | 5 | Reduced |

| Construction flooring, bamboo, nursery-made furniture | 12 | 5 | Reduced |

| Painting work and plates | 12 | 5 | Reduced |

| Cement | 28 | 18 | Reduced |

Electronics & Appliances

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Solar water heater and system, solar cooker | 12 | 5 | Reduced |

| Television set (over 31 inches) | 28 | 18 | Reduced |

| Mobile phone and Monitor | 28 | 18 | Reduced |

| Set-top box for television | 28 | 18 | Reduced |

| Air conditioner | 28 | 18 | Reduced |

| Dishwasher | 28 | 18 | Reduced |

Daily Use

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Tooth powder | 12 | 5 | Reduced |

| Comb, hair pin, hair color | 12 | 5 | Reduced |

| Toilet soap, toothpaste, dental floss, toothbrush | 18 | 5 | Reduced |

| Hair oil, shampoo, talcum/face powder, shaving cream, lotion | 18 | 5 | Reduced |

Beverages (Non-alcoholic)

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| 20-liter jug of drinking water | 12 | 5 | Reduced |

| Fruit/fruit juice-based drinks (non-carbonated) | 12 | 5 | Reduced |

| Milk-based beverages | 12 | 5 | Reduced |

| Plant-based milk (coconut, almond, cashew, walnut milk) | 18 | 5 | Reduced |

Farmers and Irrigation

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Tractor (over 1800cc engine, four-wheel) | 12 | 5 | Reduced |

| Diesel engine (less than 15 HP) | 12 | 5 | Reduced |

| Harvester-thresher and parts | 12 | 5 | Reduced |

| Soil preparation and cultivation machinery | 12 | 5 | Reduced |

| Poultry and beekeeping machinery | 12 | 5 | Reduced |

| Sprinkler, drip irrigation and nozzle | 12 | 5 | Reduced |

| Hand pump (other) | 12 | 5 | Reduced |

| Fertilizer making machines | 12 | 5 | Reduced |

| Natural manure and bio-fertilizer | 12 | 5 | Reduced |

| Tractor tires and tubes | 18 | 5 | Reduced |

| Ammonia, sulfuric acid, nitric acid for fertilizer | 18 | 5 | Reduced |

| Tractor parts (brakes, gearbox, steering, radiator, etc.) | 18 | 5 | Reduced |

Additional Items)

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Coal, lignite, peat (organic matter) | 5 | 18 | Increased |

| Non-alcoholic beverages | 18 | 40 | Increased |

| Tickets for IPL matches | 28 | 40 | Increased |

| Pan masala, cigarettes, bidi, cigars | 28 | 40 | Increased |

| Unprocessed tobacco and its waste | 28 | 40 | Increased |

| Carbonated drinks, sugar-added fruit drinks/juices | 28 | 40 | Increased |

| Bikes with engines over 350cc | 28 | 40 | Increased |

| Petrol cars with engines over 1500cc | 28 | 40 | Increased |

| Diesel cars with engines over 1500cc | 28 | 40 | Increased |

| Super luxury yachts, private jets, private helicopters | 28 | 40 | Increased |

| Betting, casino, gambling, online money gaming | 28 | 40 | Increased |

| Horse racing, lottery | 28 | 40 | Increased |

Services

| Service | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Contractor Services | 18% | 18% | No Change (with ITC) / 5% (without ITC) |

| Chartered Accountant (CA), Lawyer, Architect, Consultant | 18% | 18% (with ITC) / 5% (without ITC) | Choice based |

| Life & Health Insurance (individual, floater, senior citizens) | 18% | 0% | Exemption |

| Corporate Group Insurance Policies | 18% | 18% | No change |

| Gyms, Salons, Barbers, Yoga | 18% | 5% | Reduced |

| Restaurants (AC & Non-AC) | 12% / 18% | 5% (without ITC) | Unified lower rate |

| Hotel stays up to ₹7,500/day | 12% | 5% | Reduced |

| Hotel stays above ₹7,500/day | 18% | 18% | No change |

| Air Travel - Economy | 5% | 5% | Same |

| Air Travel - Business Class | 12% | 12% | Same |

| Railway Transport of Passengers | 5% | 5% | Same |

| Railway Transport of Goods | 5% | 5% | Same |

| Education Services (schools, colleges) | 0% | 0% | Exempt |

| Healthcare Services (hospitals, clinics) | 0% | 0% | Exempt |

| Renting of Commercial Property | 18% | 18% | No change |

Food & Kitchen

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Unpackaged/unbranded Paneer | 5 | 0 | Exemption |

| Tetra pack milk | 5 | 0 | Exemption |

| Roti, Chapati, Bajra, Pizza bread | 5 | 0 | Exemption |

| Paratha, Kulcha and Naan | 18 | 0 | Exemption |

| Butter, Ghee, other dairy products | 12 | 5 | Reduced |

| Cheese / Paneer (packaged/branded) | 12 | 5 | Reduced |

| Dry fruits (almonds, pistachios, walnuts, etc.) | 12 | 5 | Reduced |

| Farsan, Bhujia, Mixture, Chivda | 12 | 5 | Reduced |

| Pasta, Spaghetti, Macaroni, Noodles | 12 | 5 | Reduced |

| All types of pickles | 12 | 5 | Reduced |

| Vegetable and fruit juice | 12 | 5 | Reduced |

| Coconut water (packaged) | 12 | 5 | Reduced |

| Refined sugar and sugar-free products | 12 | 5 | Reduced |

| Curry, paste, mayonnaise, salad dressing | 12 | 5 | Reduced |

| Yeast and baking powder | 12 | 5 | Reduced |

| Preserved fish, meat (canned/ready-to-eat) | 12 | 5 | Reduced |

| Chocolate, pastry, cake, biscuit, jam | 18 | 5 | Reduced |

| Corn flakes and other cereal flakes | 18 | 5 | Reduced |

| Coffee | 18 | 5 | Reduced |

| Soup and Shorba (ready-premix) | 18 | 5 | Reduced |

Cosmetics & Personal Care

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Perfumes & Deodorants | 28% | 40% | Luxury Rate Increased |

| Lipsticks, Makeup Kits, Beauty Creams | 18% | 18% | No Change |

| Skincare Products (lotions, facewash) | 18% | 18% | No Change |

| Hair Dye & Hair Styling Products | 18% | 18% | No Change |

| High-end Imported Cosmetics | 28% | 40% | Luxury Rate Increased |

Jewelry & Precious Metals

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Gold Jewelry | 3% | 3% | No Change |

| Silver Jewelry | 3% | 3% | No Change |

| Diamond & Precious Stones | 3% | 3% | No Change |

| Imitation Jewelry | 12% | 5% | Reduced |

| Luxury Watches & Branded Jewelry | 28% | 40% | Luxury Rate Increased |

Household Items

| Item | Old Rate | New Rate | Remarks |

|---|---|---|---|

| Baby feeding bottles & nipples, baby napkins & diapers | 12 | 5 | Reduced |

| Sanitary matches | 12 | 5 | Reduced |

| Candles / Handmade candles | 12 | 5 | Reduced |

| Steel, aluminum, copper, brass, wooden kitchen utensils | 12 | 5 | Reduced |

| Kerosene, non-electric stove | 12 | 5 | Reduced |

| Sewing machine and its parts | 12 | 5 | Reduced |

| Rubber band | 12 | 5 | Reduced |

📄 Official References:

Full GST Rate List – Government PDF

GST Council Meeting (03/09/2025) – Item-wise Details with Chapter Numbers

Key Impacts of the New Slabs

Impact on Consumers

This is a major win for consumers. Many household goods, electronics, and daily-use items will become more affordable. However, luxury items like high-end cars, premium watches, and tobacco products will become significantly more expensive due to the new 40% rate.

Impact on Businesses

While the transition requires updating ERP and accounting systems, the long-term benefits are immense. Simplified tax filings, easier ITC claims, and fewer classification disputes will reduce compliance costs and operational headaches for businesses of all sizes.

Impact on the Economy

By making goods cheaper, the government aims to spur demand and boost consumption, especially ahead of the festive season. This can create a positive cycle of increased production, job creation, and higher economic growth. The simplified structure also enhances India's appeal as an investment destination.

How to Calculate New GST (Step by Step)

Prerequisites

- ➔ The base price (assessable value) of the good or service.

- ➔ The correct HSN/SAC code to determine the applicable new GST slab (5%, 18%, or 40%).

Steps

- 1. Determine the Base Price: Find the value of the item before tax.

- 2. Identify the New GST Rate: Check which of the three new slabs the item falls into.

- 3. Calculate GST Amount: Multiply the base price by the new GST rate.

- 4. Calculate Final Price: Add the GST amount to the base price.

Example Walkthrough

Calculating the new price of a washing machine:

- 1. Base Price of Washing Machine: ₹30,000

- 2. Old GST Rate (28%): ₹8,400. Old Final Price: ₹38,400

- 3. New GST Rate (Standard Rate - 18%): ₹30,000 x 0.18 = ₹5,400

- 4. New Final Price: ₹30,000 + ₹5,400 = ₹35,400 (A massive saving of ₹3,000 for the consumer!)

Compliance & Best Practices for Businesses

Recommended Actions

- ➡ Update Software Immediately: Ensure your invoicing and accounting software is updated with the 5%, 18%, and 40% slabs before September 22, 2025.

- ➡ Re-classify Product Master: Conduct a full review of your products and services to assign them to the correct new slab based on HSN codes.

- ➡ Train Finance and Sales Teams: Your staff must be aware of the new rates to generate correct invoices and avoid customer disputes.

- ➡ Inform Your Supply Chain: Communicate with your vendors and distributors to ensure the entire chain is aligned with the new tax structure.

Impact on Different Sectors

Consumer Durables & Electronics

This sector is a huge winner. Many items like TVs, refrigerators, and washing machines that were in the 28% slab will move to the 18% standard rate, leading to significant price drops and likely boosting sales during the festive season.

FMCG & Food Processing

The consolidation of the 5% and 12% slabs into a single 5% rate for most essentials will make daily goods cheaper. This move is expected to greatly benefit middle-class and lower-income households.

Luxury & Automotive

The luxury segment will see a major price hike. High-end cars, yachts, and imported luxury goods will be taxed at a flat 40%, a significant increase from the previous 28% + Cess structure. This is a targeted move to tax high-value discretionary spending.

Common Compliance Errors & Solutions

Using Old Slabs Post-Deadline

Problem: Continuing to issue invoices with 12% or 28% GST after September 22, 2025.

Solution: Set a hard cut-off in your billing system. Run tests before the deadline to ensure your software is correctly applying the new 5%, 18%, and 40% rates.

Incorrect Product Classification

Problem: Wrongly classifying a luxury item in the 18% slab or a standard item in the 5% slab.

Solution: Refer to the official HSN code list published by the GST Council. When in doubt, consult with a tax advisor to ensure every item is in the correct new slab.

Comparison with Global Tax Structures

The move to a three-slab system brings India closer to global best practices, where fewer slabs lead to higher efficiency and easier administration. It balances social welfare (low rate for essentials) with revenue generation (high rate for luxury).

| Country | Tax System | Standard Rate |

|---|---|---|

| India (from Sep 2025) | GST | 18% |

| Canada | GST/HST | 5% (Federal) |

| Australia | GST | 10% |

| United Kingdom | VAT | 20% |

FAQs

Conclusion

The 2025 GST reform is a bold and transformative step for the Indian economy. By replacing a complex structure with a simplified three-slab system, the government has addressed a key demand from both consumers and industries. This change promises not only lower prices on a vast range of goods but also a significant improvement in the ease of doing business. As India heads into the festive season, this reform is poised to unlock a new wave of consumption and economic growth, marking a new chapter in the country's tax history.

Get ready for the new GST era. Calculate prices with the updated rates → Use the 2025 GST Calculator